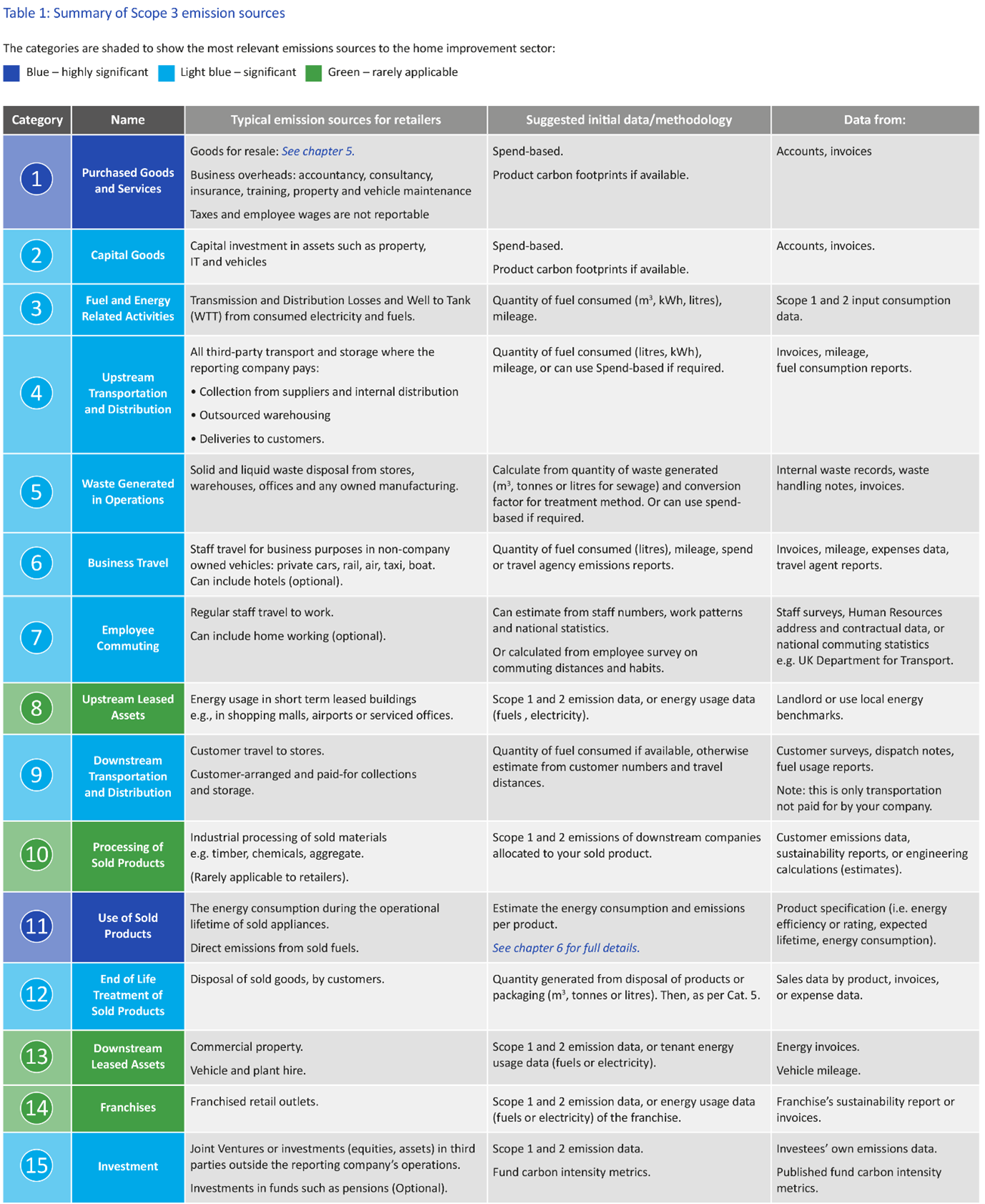

There are 15 categories that all need to be quantified to form a complete Scope 3 inventory. There are multiple ways to quantify them, with increasing degrees of complexity and accuracy. The brief guidance in the table below provides suggestions for your initial Scope 3 inventory, which may be sufficient for longer-term reporting as well for smaller emissions sources. For all Upstream categories (1 to 8), supplier or product-specific emissions data is the preferable, most accurate source of data but there are alternatives as set out in the table below

There are 15 categories that all need to be quantified to form a complete Scope 3 inventory. There are multiple ways to quantify them, with increasing degrees of complexity and accuracy. The brief guidance in the table below provides suggestions for your initial Scope 3 inventory, which may be sufficient for longer-term reporting as well for smaller emissions sources. For all Upstream categories (1 to 8), supplier or product-specific emissions data is the preferable, most accurate source of data but there are alternatives as set out in the table below

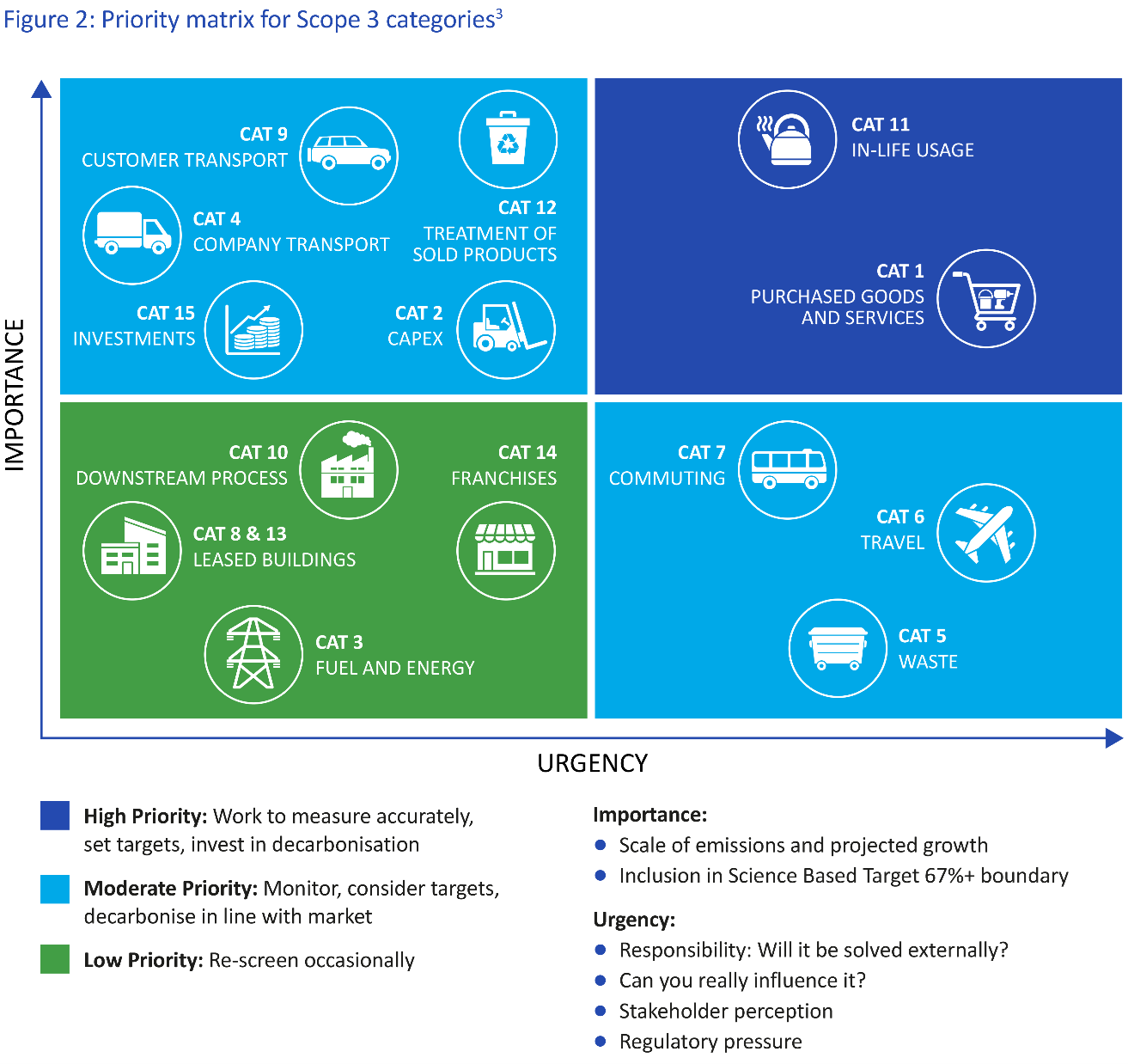

Effective management of Scope 3 depends on focussing on the most significant emissions sources. You can use a priority matrix to determine which Scope 3 categories you want to focus on for more accurate accounting and subsequent emissions reductions.

- Importance: Are the emissions a material proportion of your inventory? What is the volume of emissions?

- Urgency: Are you responsible for decarbonisation or will it be solved externally? Is there stakeholder perception of high importance or is there regulatory pressure?

For the categories that fall under high importance and urgency, focus on attaining high-quality data and ensure a robust methodology.

A survey conducted on EDRA/GHIN members, who collectively employ over 1.4 million people and generate revenues of more than €360 billion, showed Scope 3 emissions can represent up to 98% of a DIY retailer’s total emissions, so efforts to reduce these will have the most significant impact.

Scope 3 emissions are often the most difficult to measure and manage. This requires collaboration across the supply chain and meticulous data collection, which can be complex. The Scope 3 Accounting Guide offers valuable advice on how to start and effectively manage the Scope 3 reporting process.

Download the Scope 3 Accounting Guide