Introduction

This section will discuss emissions reporting for companies that; make use of franchises, provide online marketplaces or drop-ships, offer rental services, or lease space to concessions within retail stores. The specific emission reporting boundaries vary for each of the business models discussed, and depending on how your business operates any number of the following sections may apply.

Franchises

The Scope 1 and Scope 2 emissions of each of your franchisees needs to be included under Category 14 in your Scope 3 emissions reporting. If your company does not have any franchises, then you will have no Category 14 emissions to report.

Emissions from franchises can be calculated in one of two ways:

- A franchise-specific method, in which the specific Scope 1 and Scope 2 emissions for each franchise are known and added together.

- Using an average data method for all franchises.

Franchise-specific example:

Your company has two separate franchises, 'Franchise A' and 'Franchise B'.

These franchises reported emissions of:

- Franchise A Scope 1 emissions: 50 t CO2e

- Franchise A Scope 2 emissions: 25 t CO2e

- Franchise B Scope 1 emissions: 100 t CO2e

- Franchise B Scope 2 emissions: 45 t CO2e

- Your category 14 emissions would be: 50 + 25 + 100 + 45 = 220 t CO2e

Average-data example:

Your company has 100 franchises, each belonging to one of two types:

- Type 1 Franchises: 75

- Type 2 Franchises: 25

The average emissions per franchise for each type are:

- Type 1 Franchises: 120 t CO2e

- Type 2 Franchises: 200 t CO2e

Your category 14 emissions would be: (75 × 120) + (25 × 200) = 14,000 t CO2e

Therefore, the data needed to calculate Category 14 emissions will be:

- Either:

- Franchise-specific Scope 1 and Scope 2 total emissions for each franchise.

- Or:

- Estimated average emissions for each franchise type.

- The number of franchises of each type.

Does the reporting company need to account for emissions of products sold by its franchisees?

The Greenhouse Gas Protocol Scope 3 Category 14 (emissions from franchises) requires only the Scope 1 and Scope 2 emissions of the reporting company’s franchisees to be reported.

In a franchising business model, it is the franchisee that directly purchases from the manufacturer or wholesaler, then resells goods or services to the consumer from their franchised business location. It is therefore the responsibility of the franchisee to report these product-related emissions, such as Category 1 supply chain emissions, and Category 11 use-phase carbon emissions of sold products. An exception would be if the reporting company buys the products from the manufacturer, and then acting as a wholesaler then sells the products to the franchisees for resale. In this case, the product-related emissions would need to be captured in both the reporting company’s and the franchisee’s scope 3 inventories.

Marketplaces

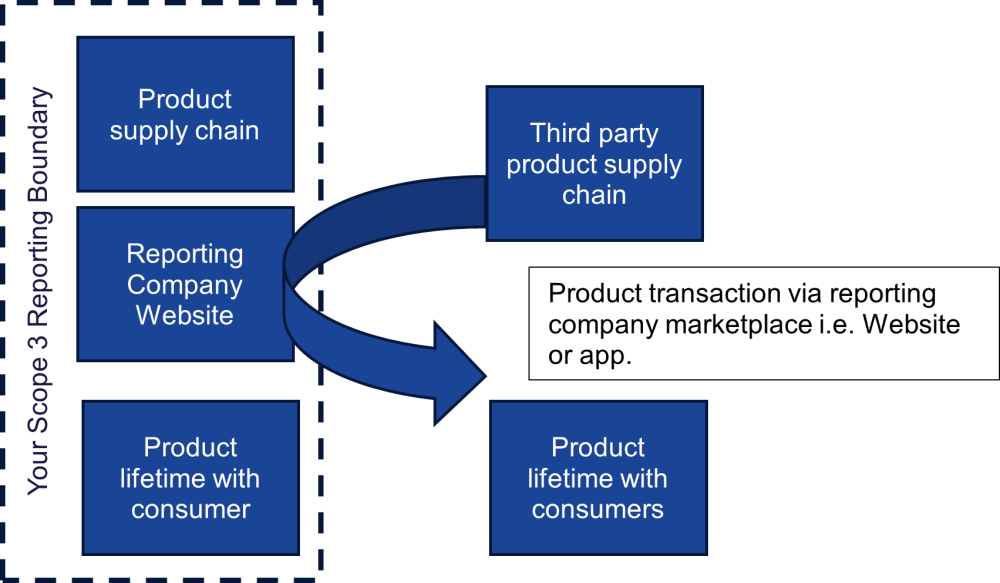

Your company may also be required to report Scope 3 emissions that result from additionally operating as an online marketplace. This applies to your company if your company website offers goods or services provided by a third-party company outside of your corporate boundary, where you have no ownership or direct control over the product sales. This section is therefore not relevant if no third-party vendors’ products can be purchased on your company’s website.

Your company, as the reporting company and provider of the online marketplace, is not directly responsible for the supply chain (Category 1, 4,9) and lifetime and end of life use emissions (Category 11 and 12 emissions) of products sold by a third-party supplier, even if the transaction occurs on your website. Your company is only responsible for the upstream and downstream emissions of any products within your own value chain, as illustrated here:

However, there may be other Scope 3 carbon emissions that do arise as a result of your company’s operation as an online marketplace which sit within your reporting boundary. You will need to consider whether any of the Scope 3 emissions categories may apply to your company’s provision of an online marketplace. This could include, although is not limited to, emissions from:

- Purchased Goods and Services (Category 1) that allow you to run the marketplace e.g. computer server hosting.

- Capital Goods Investments (Category 2) that allow you to run the marketplace e.g. IT equipment

- Fuel and Energy Related Activities (Category 3), such as the electricity usage required by hosting the marketplace.

- Upstream Leased Assets (Category 8) that allow you to run the marketplace.

Drop-Shipping:

This section applies if your company sells products without them physically passing through your own premises. This means that you facilitate the purchase of a third-party’s products in your own branch or website, before forwarding any orders on to that third-party supplier who then fulfils the order directly to the consumer.

If your company is not involved in drop-shipping, then this section will not apply.

To differentiate from an online marketplace (above), the retailer in the drop-shipping relationship is the counterparty that sells the product to a customer. This means that as a drop-shipping retailer, your company is responsible for the lifecycle emissions associated with any products purchased through your drop-shipping operations. Even if the order is then passed on to a third-party supplier that maintains the product stock and fulfils the transport and distribution of purchased products, the drop-shipping retailer is seen as the seller and is therefore required to report the upstream and downstream emissions of any sold products (Typically Categories 1, 4,11,12).

Furthermore, when an order is placed on the drop-shipping retailer’s website and fulfilled by a third-party supplier who ships directly to the customer, the drop-shipping retailer is essentially purchasing a service that includes the delivery of the sold product. Therefore, the drop-shipping retailer is normally responsible for accounting for the transportation emissions of products they sell, even if a third-party supplier handles the delivery.

Your company’s operation as a drop-shipping retailer may also give rise to other Scope 3 carbon emissions that fall within your company’s reporting boundary, such as those listed out in the marketplace section above. All indirect emissions that arise as a result of your company’s operation as a drop-shipping retailer should be considered.

Rental Services:

Your company will also be required to include any emissions arising through the use of any products or services that you rent out to other companies if they consume electricity or fuel, or release greenhouse gases. These emissions should be reported under Category 13 (Downstream Leased Assets). This is applicable where you own the product that is rented out or leased to customers.

The reporting of emissions under Category 13, should be performed on the basis of how long each product is rented out for within the given reporting year. For example, if your company offers a rental service for power drills, the Category 13 emissions of your rental service could be calculated as below:

- Estimated cumulative usage time during rental periods in the reporting year: 300 hours

- Tool product power rating: 50 Watts

- Electricity emission factor: 0.5 kg CO2e per kWh

- The category 13 emissions would be: 300 hours × (50/1000)W × 0.5 kg CO2e per kWh = 7.5 kg CO2e per tool

Then, multiply by the number of products that are provided for rental. The methodology is broadly the same as that used in Category 11 but should only account for leases during the reporting year. It should also be noted that the usage profile is likely to differ between consumer and professional users of the products.

The supply chain emissions of the purchased product should be captured in Category 1 or 2, depending on whether you treat them as Operational or Capital goods, respectively.

The emissions arising from the end of life treatment of rental products that have reached the end of their operational service-life should be included under Category 5 (Waste Generated in Operations) as this category represents waste arising from within your own operational sites rather than the consumer. However, if the product is subsequently sold after being offered as a rental item it can then be treated like any other sold product for downstream emissions accounting purposes Best wish- see separate guidance on Category 11 and 12.

Concessions:

If your company leases out any space within a retail site to third-party concessions, then there may be additional emissions within your reporting boundary relating to the operation of these concessions. If there are no third-party concessions operating at any of your company’s stores, this section will not need to be considered.

It is likely that emissions arising due to the operation of concessions within your company’s retail stores are already accounted for under your company’s Scope 1 and Scope 2 emissions accounting. This is the case if the concession’s use of energy and other utilities is included in your site totals. However, if the concession has its own separate utility supply that is not captured in your scope 1 and 2 emissions, then this consumption should be accounted for in Category 13, downstream leased assets.

Note that emissions associated with product sales at concessions are subject to the same guidance as marketplaces and franchises, above.

Further resources:

Additional information can be found in the Make it Zero – Scope 3 Accounting Guide:

Several chapters of the Greenhouse Gas (GHG) Protocol – Scope 3 Calculation Guidance are of particular relevance to this article. These are:

- Category 14 – Franchises: Chapter14.pdf

- Category 11 – Use of Sold Products: Chapter11.pdf

- Category 9 – Downstream Transportation and Distribution: Chapter9.pdf

Supporting documents, including for all Scope 3 chapters, from the GHG Protocol – Scope 3 Calculation Guidance are available here: