Introduction

Scope 3 greenhouse gas (GHG) emissions represent the indirect emissions generated throughout a company’s value chain, both upstream and downstream. Among the 15 categories of scope 3 emissions defined by the Greenhouse Gas Protocol1, category 15 relates to emissions associated with a company’s investments. This category is typically a significant emission source for financial institutions whilst for many businesses these emissions constitute a small portion of their total greenhouse gas inventory. However, it may be relevant for retailers and manufacturers involved in investments, including but not limited to equity investments, joint ventures, project finance, or pension funds. This chapter aims to provide retailers and manufacturers with an overview of how to identify, measure, and manage emissions linked to their investments.

For non-financial organisations investment emissions are most prevalent in business operations that lie outside the companies chosen boundary setting method. For example, and organisation has chosen operational control over several entities and records all emissions from those entities in scope 1,2 and 3 accordingly. Entities where the reporting company has an equity share but not operational control the organisation must include the scope 1 and 2 emissions of the entity in its investment emissions category.

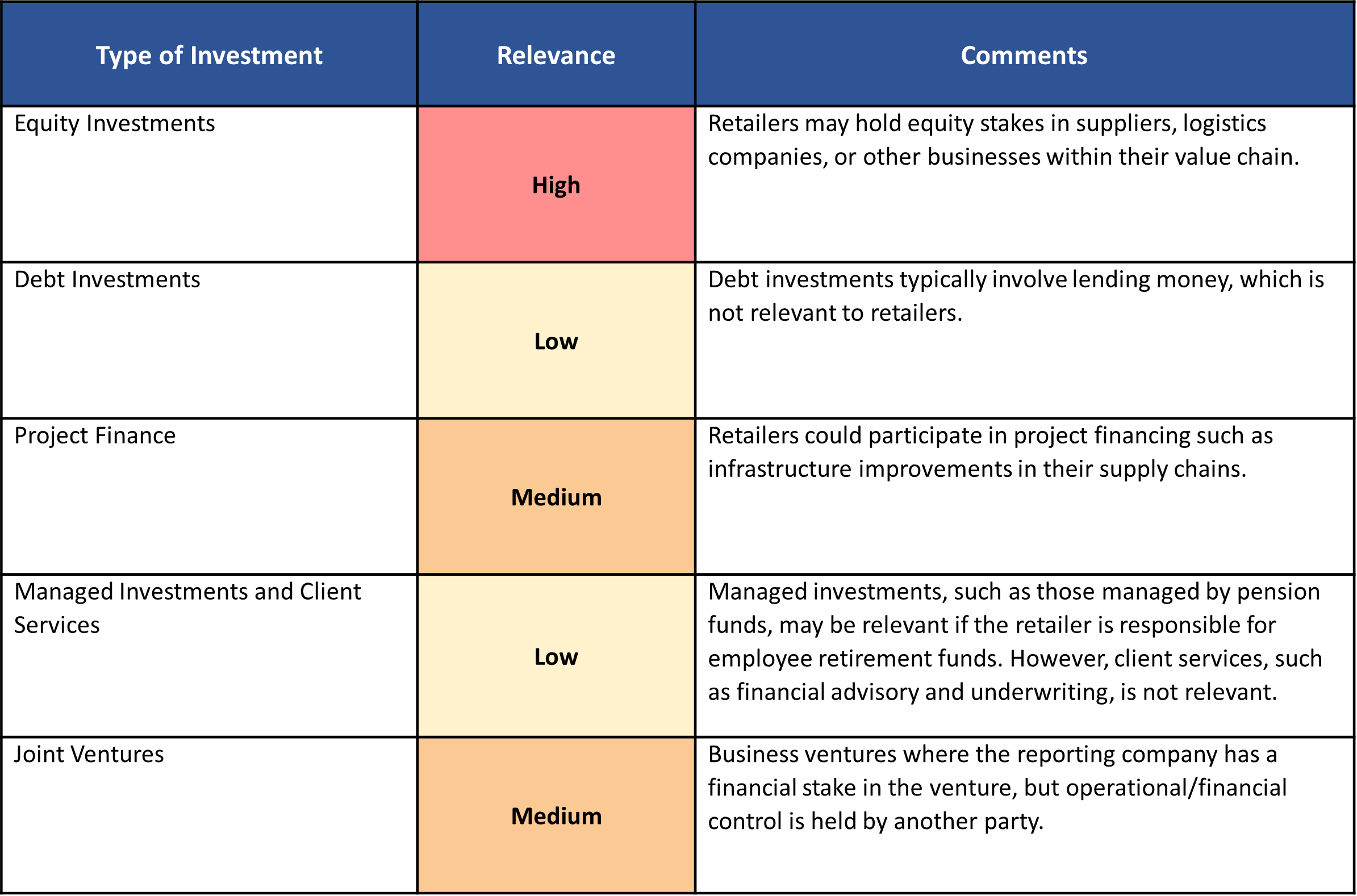

Relevance to the DIY Sector

The GHG Protocol corporate value chain standard divides category 15 financial investments into four types listed out in the table below.

Accounting for Emissions from Investments

Equity Investments

These are investments where the company purchases ownership stakes in other businesses, which may include subsidiaries, associates, or joint ventures. Equity investments give the company partial or full ownership in the investee, and the investor’s share of emissions is proportionally reported based on its ownership stake.

Retailers should account for emissions from equity investments in scope 1 and scope 2, using the equity share consolidation approach. This ensures proportional scope 1 and scope 2 emissions from equity investments are included in the retailer’s GHG inventory.

However, if a company uses either operational or financial control and lacks control or significant influence (typically less than 20% ownership) then emissions should be reported under scope 3 category 15 based on the proportional share of emissions from these investments.

The below shows an example using the investment-specific method. A retailer holds a 10% equity stake in a regional logistics company that has reported 10,000 tCO₂e scope 1 emissions and 5,000 metric tCO₂e scope 2 for the reporting year. This can be achieved by periodically engaging with the portfolio of investments to request primary data on the operational emissions.

When the investment-specific method isn’t available the average-data method can be used multiplying revenue data from the investee company by EEIO (Environmentally extended input output) (Spend based) emission factors to estimate the Scope 1 and Scope 2 emissions. These emissions are then allocated based on a company’s equity stake. While the average-data method offers a simplified estimation the investment-specific method is more accurate and recommended when emissions are significant.

Some organisations have operations like their own that lie outside their boundary setting criteria so need to be considered as Investments. An example may be a DIY Supplier has a minority stake in a similar supplier making the same products. In these instances, the reporting companies scope 1 and 2 emissions could be used as a proxy for the similar investment entity. The emissions can be scaled to the entity using a reference metric such as revenue or production quantity to estimate the entities scope 1 and 2 emissions.

Project Finance

Retailers could participate in project financing such as infrastructure improvements in their supply chains or power generation such as solar farms powering their retail stores. These projects could have significant emissions, especially for large-scale investments.

If a retailer is involved in financing a project, then they must account for proportional scope 1 and scope 2 emissions from the project. Additionally, for projects financed during the reporting year, total projected lifetime emissions should be reported separately from scope 3 emissions.

There are a number of ways emissions can be calculated depending on data availability2:

- Reported Emissions: If verified emissions data is available from the project (e.g., from environmental assessments), these should be used.

- Physical Activity-Based Emissions: If reported emissions are unavailable, emissions could be calculated using activity data (e.g., fuel or electricity consumption) and emission factors.

- Economic Activity-Based Emissions: If physical data is unavailable, sector-specific emission factors per £ of investment could be used to estimate emissions.

Project-specific reported emissions are the most reliable in terms of quality and consistency, but they can be challenging to obtain. Retailers should collaborate closely with suppliers to enhance transparency and improve data accuracy over time.

A retailer invests in the construction of a solar farm that costs £100 million, of which it contributed 20% through equity investment, while the remaining is financed by other investors. The solar farm is expected to produce 5,000 tCO₂e during its construction.

Project life-time emissions also have to be reported separately which includes both the emissions from construction and the yearly operational emissions over the anticipated lifetime of the project in proportion to the retailer’s investment.

Managed Investments and Client Services

Managed investments, such as those managed by pension funds, may be relevant if the retailer is responsible for employee retirement funds. To measure emissions from pension fund investments a company should work with the fund managers to obtain a detailed breakdown of the pension fund’s investments including identifying the sectors, companies, and projects in which the fund is invested in.

Emissions can be calculated using either the investment-specific method or the average-data method, depending on data availability like Equity Investments. For the investment-specific method emissions data (Scope 1 and 2) for each company or project should be obtained then allocated proportionally to the retailer's share of the fund. When this is not available the average-data method can be used. For example, if the fund heavily invests in utility companies, you can apply average emissions for the utility sector to approximate emission.

Investment Emissions accounting for the DIY sector Quick tips

- Clearly define your boundary setting criteria

Ensure that your boundary setting criteria is well defined within your GHG emissions inventory and clearly document the reasoning why this method was chosen. Operational control is often assumed for most DIY companies but this needs to be made clear to any auditor that may review calculations/methodology.

- Understand your organisational structure

Define the entities that make up your organisational structure, define the equity share in each of those entities and then determine if you have operational/financial control – Account for the full value chain emissions for entities where you have control and account scopes 1 and 2 for companies without operational control. Ensure that you review your organisational structure and review entities annually.

- Identify the data that is available on the entity

As investment emissions lie outside the scope of an organisations control, specific data requires engagement or when not available estimations are needed.

Review the data available and select the method that is most accurate and likely to represent the operational emissions of that investment. Primary data is the most accurate but requires the entity to carry out a carbon inventory of their own and be willing to share the data. This often means the most suitable method is an average data method of estimation.

- Improve method over time

Estimations are a suitable method to understand the baseline emissions and ensure a complete inventory of emissions. Depending on the size of investment emissions prioritising investee engagement will lead to more primary data and initiate levers for decarbonisation.

1 Corporate Value Chain (Scope 3) Standard

2 The Partnership for Carbon Accounting Financials (PCAF), Part A: Financed Emissions